Rwanda has been a leader in implementing innovative approaches towards achieving technological advancement. One of their noteworthy efforts is the Electronic Mortgage Registration System (EMRS), a modern system used to register mortgages on property throughout the country. This system has enabled Rwanda to manage possession and ownership of real estate more effectively than ever before and is essential for the legal resolution of disputes related to real estate and mortgages.

This system currently manages the process of registering mortgages electronically, which allows for faster processing and easier accessibility by both borrowers and lenders. Rwandan homeowners and other stakeholders now have the convenience of having the entire process managed digitally from start to finish. In this article, we will explore how Rwanda’s EMRS works in practice and its potential benefits for both borrowers and lenders.

The EMRS simplifies paperwork and other processes involved with registering property assets, all while providing a secure, reliable way for lenders and borrowers to validate ownership claims. With its state-of-the-art infrastructure, efficient operating system and easy integration with existing systems, Rwanda’s EMRS is an example that many other countries should follow in order to boost economic growth. This system is accessed through the Rwanda Development Board website (https://org.rdb.rw/).

This site provides a friendly user interface and three types of services: business registration, mortgage registration and intellectual property. Mortgage registration is done by the lender with written approval from the borrower, owner and spouse.

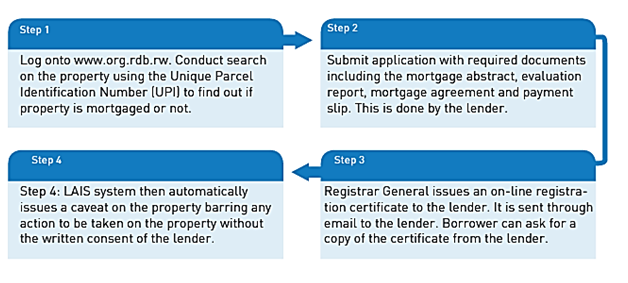

Once you access the Mortgage Registration section, you will need to set up a public account on the website. Registration takes four simple steps. The simplified process is shown in the diagram below:

The online mortgage registration system provides a simplified form that combines all legal documents into one. It is signed by the lender, the borrower and his/her spouse, and the owner of the house or land. It is linked to the Land Administration Information System (LAIS) and the National Identification Agency (NIDA).

There is a provision for legal documents relating to the type of registration one is effecting, but they have not been provided on the site. It is advisable to seek the services of an advocate who is conversant with the laws of Rwanda to provide legal counsel and services relating to effecting the registration of a mortgage.

Rwanda’s Electronic Mortgage Registration System (EMRS) is revolutionizing the way mortgages are registered in the country. The EMRS ensures faster registration of mortgaged properties and allows both lenders and borrowers access to electronic mortgage deeds in a matter of minutes. It is one of the key components of Rwanda’s highly successful economic development strategy as it serves to reduce transaction time and costs, decrease fraud and ensure the secure transfer of titles between parties. In addition, this system also provides an efficient and transparent platform for lenders, lawyers and banks to interact with each other when registering their mortgage instruments. This has had a great impact on the real estate market in Rwanda as it has helped property owners register their properties quickly, efficiently and securely while also reducing the costs associated with obtaining a mortgage.