Land disputes and legal risks can pose significant challenges to property buyers and investors, making it crucial to adopt effective measures for safeguarding interests in land. This article delves into the significance of due diligence in safeguarding land interests in the dynamic real estate markets in Kenya and Uganda. By conducting comprehensive due diligence, investors can make informed decisions and enhance the security of their real estate investments.

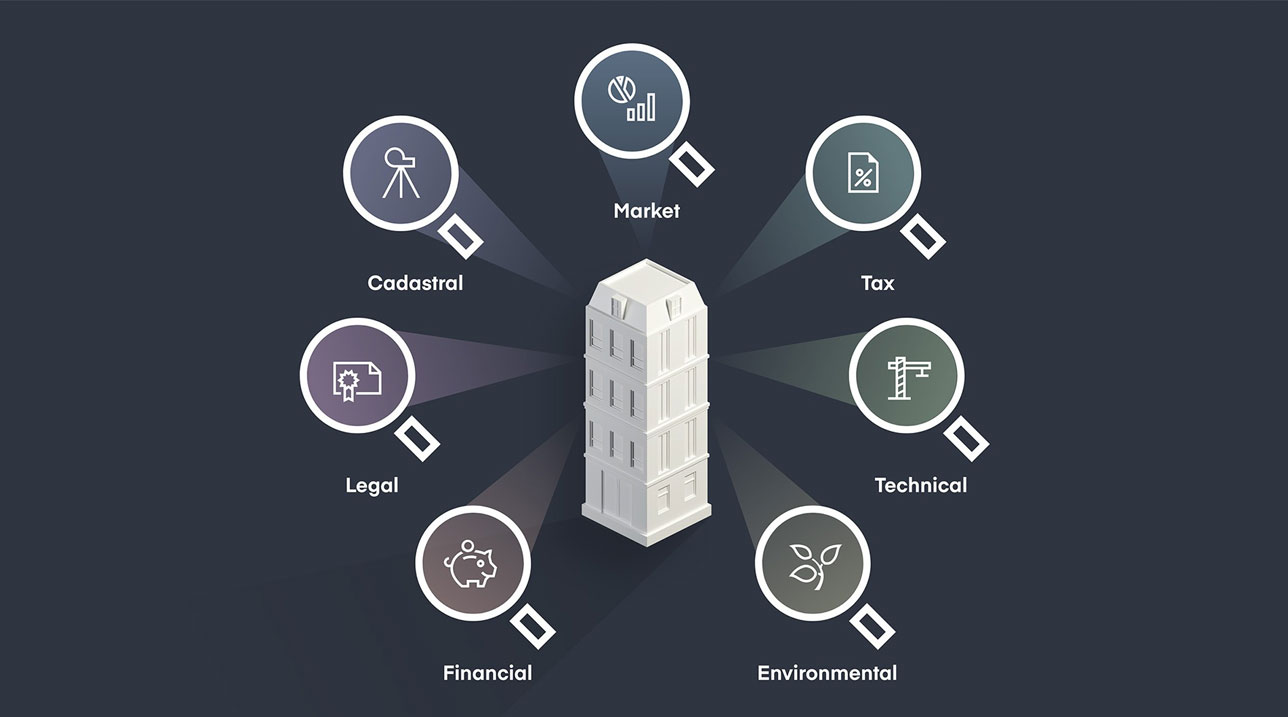

Due diligence is a comprehensive investigative process that involves evaluating various aspects of a property to assess potential risks and liabilities. By conducting due diligence, investors can make informed decisions and protect their interests. Some of the key areas covered in the due diligence process include:

- Title and ownership issues: Reviewing the property’s title history is crucial to ensure that the seller possesses a clear and marketable title. This will allow investors to identify any encumbrances, liens, or legal disputes that might affect the property’s ownership and transfer.

- Zoning and land use regulations: Assessing compliance with local zoning and land use regulations is essential to avoid penalties, restrictions, or demolition orders resulting from zoning violations.

- Environmental compliance: Checking for environmental issues associated with the property, such as contamination or hazardous waste, is essential to prevent costly cleanup requirements and potential legal liabilities.

- Contract and lease reviews: Scrutinizing existing contracts and leases ensures that there are no undisclosed agreements that may impact the investor’s plans for the property.

- Building and construction permits: Verifying building permits and approvals ensures that the property was developed in compliance with applicable building codes and regulations.

- Easements and rights-of-way: Identifying any easements granted on the property is vital, as they may affect the property’s use and development.

- Tax and financial liabilities: Conducting a financial review helps uncover any outstanding property taxes, utility bills, or other financial liabilities associated with the property.

- Regulatory approvals and compliance: For specific real estate investments, certain regulatory approvals may be required. Ensuring compliance with relevant regulations is essential to avoid potential legal issues.

- Litigation and legal disputes: Thoroughly researching legal records helps identify ongoing or past litigation involving the property or its previous owners, mitigating potential legal risks and liabilities.

- Local authorities’ laws and regulations: Compliance with all applicable local laws and regulations related to real estate transactions is essential for a successful investment

Investing in real estate in Kenya and Uganda presents lucrative opportunities, but it also involves certain risks. Prioritizing due diligence empowers investors to make well-informed decisions, negotiate effectively, and mitigate potential liabilities. Additionally, considering title insurance emerges as a valuable tool for financial security and peace of mind for property owners and lenders alike.

By adhering to rigorous due diligence practices, investors can contribute to the growth and development of these vibrant East African economies while safeguarding their land interests in an ever-evolving real estate landscape. Conducting due diligence is key to successful and profitable real estate investments in Kenya and Uganda.